CCJs - what to do if you get a County Court Judgment

CCJ Helpline

0800 368 8231

CCJs: What are they?

Received a CCJ? Wondering what to do?

Over 69000 CCJ's are issued every month, mainly through Northampton County Court by debt collection agencies. So you are not alone!

Firstly DON'T PANIC, we help 100's of people a day deal with CCJ's and in this guide we'll explain everything you need to know to deal with a County Court Judgement.

We'll explain what to do if you've been sent a claim form, show you how to defend a CCJ, explain what happens if you've got one and what you can do about it!.

We also cover how they affect your credit report and future borrowing and how to get a CCJ removed from your credit report.

In this Guide

- What is a County Court Judgement or CCJ for short

- Received a County Court Claim form?

- 5 options to deal with the CCJ claim

- Respond to the CCJ claim online

- Get help with the Court Claim form

- What happens if I don't send the claim form back?

- Judgment for Claimant (in default) letter

- What happens at Court?

- How much interest can the creditor claim?

- What happens if I still don't pay my CCJ?

- Notice of Issue of Warrant of Control

- Court Bailiffs

- Can I cancel a CCJ?

- How will a CCJ affect my credit file?

- How long does a CCJ last?

- Can I remove a CCJ from my credit report?

What is a CCJ?

A CCJ is a judgement that a county court issues when someone has failed to pay money that they owe. CCJs are a simple way for creditors to claim the money they're entitled to.

When you owe money to someone, they can apply to the County Court for a judgment (CCJ) against you to claim the money.

When someone takes a County Court action against you, the Court will send you a CCJ Claim Form. This court form will explain how much the creditor says you owe them.

Need help with a CCJ?

FREE CCJ HELPOur experts deal with 100's of CCJ's every day. Get free help to deal with your CCJ NOW!.

Received a County Court Claim form?

If you’ve received a County Court claim form. This means your creditor has asked for a County Court Judgment (CCJ), usually from Northampton County Court Business Centre, which will order you to pay back the debt.

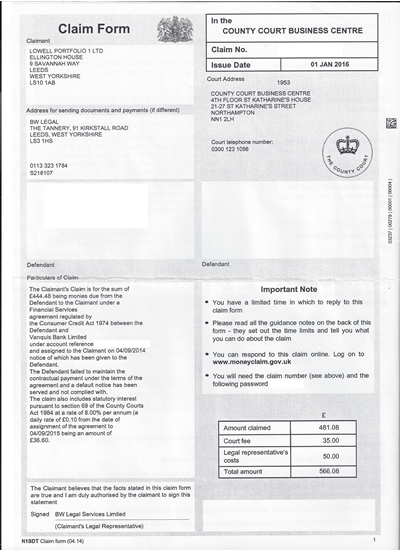

It will look like the copy of a CCJ N1 claim form below:

Check the claim form has the court's official stamp on it. If it doesn't have a stamp the person you owe money to might be trying to get you to pay them back by pretending to send you court papers. This could count as harassment by your creditor and might be against the law.

If you think the claim might be false call the CCJ Helpline on 0800 368 8231

If this is what you have received then don't panic, We'll explain exactly what you need to do!

Here's what you need to do!

It is important that you do not ignore the County Court claim form, even if you don't owe what they claim, the claim form must be dealt with in the right way and within a set amount of time.

If you receive a CCJ you have 14 days to respond.

If you dispute the claim you can send back the Acknowledgment of Service within 14 days and get 28 days in total to file your defence. The 14 or 28 days start 5 days after the ISSUE DATE printed in the top right corner of the Court Claim form.

It’s important to respond in the timeframe above, as if you don’t the court will issue the CCJ and can take further action to collect the debt.

If your confused by the dates or just need some help with the forms, just call the CCJ Helpline on 0800 368 8231

You now have 5 options to deal with the CCJ claim:

Option 1: Pay in full

You can choose to pay the amount in full straight away (plus any interest and court fees shown). If you do, you don't need to send the forms back. There won't be a court hearing and you won't have a CCJ recorded against you.

Option 2: Ask to pay later or in instalments

If you owe the money claimed, but don't have the money to pay the claim in full you can ask to pay later or in instalments.

If you want to offer to do this, fill out the form saying how you'd like to pay. A CCJ will be issued but the court will set your repayments of the CCJ based on information you provide about your income and spending.

Need help with the Court Claim form?

FREE CCJ HELPOur experts deal with 100's of CCJ's every day. We can help you dispute or defend a CCJ or ask for installments.

Option 3: Dispute the amount owed

If you admit to owing the creditor some money, but think you owe less than they are claiming you owe, send the forms back explaining why.

You should pay what you think you owe straight away or ask for time to pay the amount that you think you owe.

Option 4: Dispute the claim completely

If you don't think you owe anything, return the Defence Form to the court, setting out your side of the argument. You can ask for more time if you fill out the 'Acknowledgement of Service' form.

You must have good legal reasons for defending the claim. You can't defend a claim just because you can't afford to pay the debt, or you forgot you owed the money.

If you want to dispute the claim please call the CCJ helpline on 0800 368 8231 (freephone, including all mobiles) and we will check you have a proper defence and help you to fill in the defence form.

Or click here and one of the team will call you back.

Option 5: Claim against the creditor

If you don't think you owe anything, return the Defence Form to the court, setting out your side of the argument. You can ask for more time if you fill out the 'Acknowledgement of Service' form.

You can also view our guide to the 8 sections of the bankruptcy application. This shows screen shots of each section and details you need to enter.

Option 5: Claim against the creditor

You might think you're owed money instead.

A good example of this would be if a builder sues you for non-payment, say, but you think he owes you money for breaching the contract.

You'll need to fill out the counterclaim form (there may be a fee to do this).

Need help with the Court Claim form?

FREE CCJ HELPOur experts deal with 100's of CCJ's every day. We can help you dispute or defend a CCJ or ask for installments.

Respond to the claim online

Providing the claim has been issued from Northampton County Court Business Centre you can post your reply online. Just visit www.moneyclaim.gov.uk . You will need the claim number and the password that will be on the N1 claim form the court have sent you.

Respond to the claim by post

If you are not responding using the moneyclaim online service then you need to send the N9A form back to the "address for sending documents and payments (if different)" which is the second box down on the left hand side of the claim form. This may be the creditor but is often their solicitors address. Don't send the N9A back to the court.

Make sure that you photocopy of take a photo of all the pages with your phone or camera before you send it. KEEP THIS for your records.

Send your completed forms by first class recorded delivery, allowing time for them to get to their destination before your time limit runs out. Make sure that you also keep proof of postage.

What happens if I don't send the claim form back?

Whatever you do, DO NOT IGNORE the claim form or miss the deadline.

If you do nothing, the claimant can request a default judgment. You won't get to put your case (or explain your financial circumstances), and the CCJ may order you to pay the money in full at once.

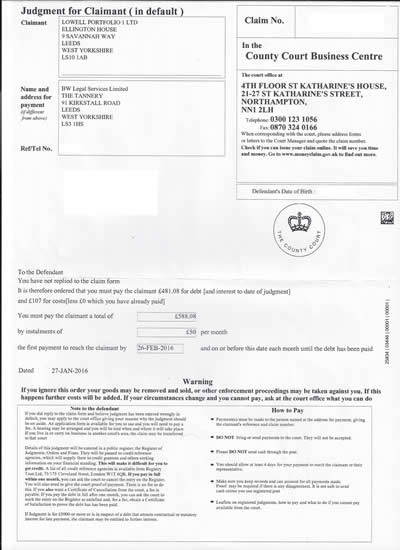

The Court will then send you a letter titled ‘Judgement for Claimant’. This means the CCJ is registered. This will be recorded on your credit file for 6 years, unless you pay it in full within one month of the date of the judgement, in which case you can ask the court to cancel the entry on the Register.

Below is an example of a Judgment for Claimant (in default), issued on behalf of Lowell Portfolio 1 Ltd.

If you have received a Judgment for Claimant (in default) letter, you need to contact us immediately, as your creditor can start enforcement action including the use of bailiffs.

To find out more about getting a court order changed or set aside call the CCJ helpline on 0800 368 8231

Need help with a CCJ?

FREE CCJ HELPOur experts deal with 100's of CCJ's every day. Get free help to deal with your CCJ NOW!.

What happens in court

The CCJ hearing is simple and held in private. You don't have to attend unless you're disputing the claim - the court will consider the evidence in your admission form.

If the court decides you owe the money, it will issue a CCJ. This is a court order saying you must repay the debt, and setting out how (e.g. regular monthly payments).

How much interest can the creditor claim?

Once a CCJ is issued against you, you will normally be required to pay the debt either immediately in full or by monthly instalments. If the Court has stated you are required to pay be monthly instalments it is very important to understand whether or not additional interest can be added to the debt. If it can this will significantly increase the time it will take you to repay what you owe.

The rules regarding interest on CCJ's are quite complicated, it depends on many things including the type of debt, the original contract, the amount of the debt and when the creditor last wrote to you. So if you advice on this please call the CCJ helpline on 0800 368 8231

If you can't or don't pay the CCJ

The court will set your repayments based on information you provide about your income and spending.

If you don't pay, the creditor can return to court to enforce its judgment - this will incur more costs and can reulst in an attachment of earnings order, charging order or the use of bailiffs.

If you genuinely can't pay a CCJ, you can ask the court to change the amount of your payments, or even suspend them.

Need help with a CCJ?

FREE CCJ HELPOur experts deal with 100's of CCJ's every day. Get free help to deal with your CCJ NOW!.

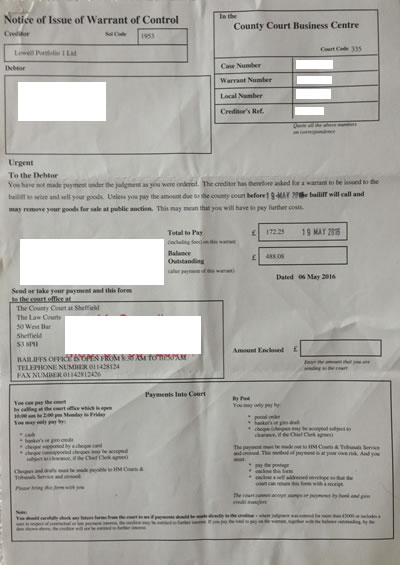

Notice of Issue of Warrant of Control from Bailiff

This is the final warning from the County Court that you have not paid your CCJ, and that County Court Bailiffs will be attending your property, and is sent from the Court.

It will give a date by which the debt must be settled.

It will usually contain the Bailiffs contact details, asking you to call them to pay.

Below is a photo of a Notice of Issue of Warrant of Control, stating the bailiff will call and may remove your goods for sale at public auction.

If you have received a Notice of Issue of Warrant of Control you need to contact us immediately.

Received a Warrant of Control Notice?

FREE HELP NOWGot a CCJ, being threatened with Bailiff action?

Get FREE help NOW to stop the Bailiffs.

Court Bailiffs

If you have a CCJ and have not made payment, your creditor can ask the County Court to send bailiffs to your home to get payment from you or to remove and sell your goods to pay the debt.

You can read our guide to Bailiffs for more information.

Can I cancel a CCJ?

If you don’t owe the money and believe the CCJ was issued in error, you can ask the court to cancel the county court judgment (CCJ) or high court judgment.

To do this you need to apply to the Court to have the Judgment set aside.

You can apply to have the judgment set aside if you didn’t receive, or didn’t respond to, the original claim from the court saying you owed the money.

To get a judgment set aside, fill in a application notice (N244), and send it to the court.

You may have to pay a court fee of £255 to do this.

Once the court has your N244 form it will write to you with a hearing date and you’ll have to go to a private hearing at the court to explain why you don’t owe the money.

If the court rules in your favour the CCJ will be removed.

How will a CCJ affect my credit file?

The short answer is in a big way!

If you have a CCJ a record of it is added to the Register of Judgments, Orders and Fines within one month of the CCJ being issued. It then stays on the CCJ register for six years.

Having a CCJ will make it far harder for you to get credit or a mortgage. Banks and other lenders can do a CCJ check against the CCJ register when deciding whether to offer credit. Getting a mortgage with a CCJ or a loan with a CCJ is difficult. Even if you get credit, you may end up paying a higher interest rate.

How long does a CCJ last?

If you repay the full amount within a month of receiving your CCJ through the post, the judgment will be removed from the CCJ register and there will be no record of it on your credit file. This means it won’t affect your credit rating at all.

However, if you take longer than a month to repay the amount, a record of the CCJ will stay on your credit file for six years. And even though it will be marked as 'satisfied', anyone searching for your credit history will still see a CCJ against your name.

Need Help With A CCJ?

If you have a CCJ and are being threatened with enforcement action, or you have received notice of a CCJ application then you need to get professional advice as soon as possible.

Simply call the team FREE on 0800 368 8231. Our experts deal with 100's of CCJ's every day. Get free help to deal with your CCJ NOW!

More Debt Advice:

What Is An Individual Voluntary Arrangement?

ReadAn individual voluntary arrangement or IVA for short, works as an alternative to bankruptcy...

How Long Does It Take To Go Bankrupt?

ReadSo how long does it take to go bankrupt? Bankruptcy can be implemented very quickly but it can vary depending on your individual circumstances...

What is a debt relief order? (DRO)

ReadWondering if you can get a debt relief order, sometimes referred to as DRO? This section explains what a debt relief order is, and the steps you need to take to apply for a debt relief order...