Tax Credit Overpayment.

Don't Panic, We Can Help

Tax Credit Overpayment Helpline

0800 368 8231

Being Chased For Tax Credits Overpayment?

Have you had a letter saying you have been overpaid tax credits?

Or are you getting chased by a debt collector on behalf of HMRC?

You are probably shocked, upset and worried.

Lots of questions are probably running through your head.

How can I have been overpaid tax credits?

What can I do?

How am I going to pay it back?

Can I appeal the overpayment?

DON'T PANIC! We have the answers to help with tax credit overpayments.

This guide helps you to find out more about your tax credits overpayment. It explains what you can do about it, and how we can you help you deal with it.

Get Help With Tax Credits Overpayments

Our experts can quickly advise you on what to do if you have got tax credits overpayments problems. Simply call the team FREE on 0800 368 8231.

Get free help NOW!

Received a letter saying you've been overpaid tax credits

If you have received a letter saying you've been overpaid tax credits and demanding repayment you may be panicking.

You probably didn't even know you'd been overpaid.

You may not even have got a letter.

Sometimes HMRC just take the money from your payments.

So you may just have noticed a big drop in the amount of money you are getting from tax credits.

However, if you've been overpaid tax credits you may have to pay some or all of it back, or HMRC will take steps to make sure you do.

What is a tax credit overpayment?

Tax credit overpayments are either from "Child Tax Credit" or "Working Tax Credit".

At the end of every tax year HMRC check to see if they have paid you the right amount for the year just gone.

If they have paid you more than they think they should have, then you will have a tax credit overpayment.

How have I been overpaid tax credits?

There are many reasons why overpayments occur.

Like many people you may be shocked to find out that you can have a tax credit overpayment even if you have done everything correctly.

Tax credits have helped thousands of families, but the system is not without its problems.

Tax credits are based on last years details, then checked again at the end of the year when you complete your renewal forms.

So if your wages, employment or household circumstances changed, but HMRC kept paying at the rate they set before the change, you could have been overpaid your tax credits.

The problem is that it's very difficult for you to accurately check your award, so most people can't check whether they are being paid too much.

Sometimes you may have been overpaid even though your income or circumstances haven’t changed.

This happens if you don’t return the renewal forms to HMRC.

So you may, through no fault of your own, been overpaid tax credits.

You will have used this money in your weekly/monthly budget, it's now spent, but now HMRC want you to repay the money.

How far back can tax credits claim overpayment?

As a rule of thumb, 6 years.

Tax credit debts are subject to the limitation act like any other debt (other than income tax).

This means if you tick the boxes below, the debt can not be enforced through the Courts.

- The debt is over six years old

- No payments have been made to it during those 6 years

- You have not admitted the debt to HMRC or it's agents

- You have not deliberately avoided contact (i.e. given a fake address)

HMRC will still probably continue to write to you, or pass your file to a debt collection agency to chase payment though.

Often with tax credits there is a period of ongoing recovery from an award. So you can't just go from the year of debt to work out that the 6 years have expired.

How will they make me pay it back?

HMRC will get the money back in one of these ways:

- taking the money of your benefits each week/month

- take the money from your wages by changing your tax code

- use a debt collection agency

- taking you to court

- send bailiffs to your home

The debt collection companies HMRC use are listed here.

So if you are getting texts, calls and letters from any company on that list, it could be for a tax credit debt.

Get Help With Tax Credits Overpayments

Our experts can quickly advise you on what to do if you have got tax credits overpayments problems. Simply call the team FREE on 0800 368 8231.

Get free help NOW!

Do I have to pay back tax credit overpayment?

The short answer to this one is YES.

The amount you have to pay back and when depends on your current circumstances and the Governments code of practice:

You can download the full Government guidance on tax credit overpayments here.

But it's quite a lengthy read, 20 pages to be precise.

It may leave you more confused than when you started. So we've put all the important bits below.

If you do download the guide, and want some help with how it applies to you, just call our helpline on 0800 368 8231.

Paying if you still get tax credits

HMRC will automatically reduce your future tax credit payments. They will do this until you’ve paid back all the money you owe.

The amount they’ll reduce your tax credit payments by usually depends on how much you currently get and your household income.

| Household Income and your tax credits award | Benefits Reduction |

|---|---|

| Income of £20,000 or less and you get maximum tax credits | 10% |

| Income of £20,000 or less and you DON'T get maximum tax credits | 25% |

| If your total household income is more than £20,000 | 50% |

| If you only get the family element of Child Tax Credit | 100% |

Paying if you don't get tax credits anymore

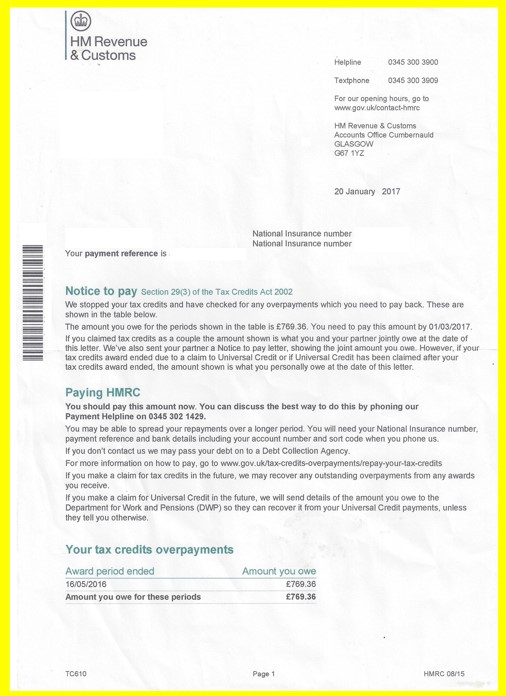

HMRC will send you a "notice to pay" section 29(3) letter.

This letter will tell you that you were paid too much. It will also tell you the amount HMRC want you to pay back, and the fact they want it back within 30 days.

If you get a letter like this, and you can't afford to pay it back within 30 days, do not ignore it hoping it will go away.

We can help you put a budget together, and show HMRC what you can actually afford to pay.

We can then arrange a "time to pay arrangement" with HMRC, this may be able to spread the repayment over 12 months to 10 years.

Under certain circumstances you may be able to get HMRC to put it on hold for 12 months.

In extreme circumstances you can even get the tax credit overpayment debt written off.

Our experts can quickly advise you on what to do if you have got tax credits overpayments problems. Simply call the team FREE on 0800 368 8231.

Get free help NOW!

I don't agree with the overpayment?

If you don't agree with the amount HMRC are claiming was overpaid, then you can dispute it.

To do this you need to call HMRC on 0345 300 3900 or send them a tax credits overpayment appeal form (TC846).

The time limit to dispute a tax credit overpayment is within 3 months of finding out about it.

HMRC will continue to reclaim or chase the debt whilst they review your appeal.

What if I miss the 3 month time limit?

You can still dispute it, but you will need a very good reason for missing the deadline.

For example, if you got the wrong advice from the HMRC’s helpline or if you have been seriously ill.

Make sure you include your reason for being late at the start of your dispute letter.

Get tax credits advice

Most people find tax credits hard to understand.

You may have had award letters with different amounts on. 8 pages of different numbers, all very confusing.

If you are unsure, and would like someone to check your overpayment or help you with an appeal, just call the helpline free on 0800 368 8231 or click the "Tax Credits Help" button below.

Tax Credits Overpayments Advice

Our experts can quickly advise you on what to do if you have got tax credits overpayments problems. Simply call the team FREE on 0800 368 8231.

Get free help NOW!

More Debt Advice:

An individual voluntary arrangement or IVA for short, works as an alternative to bankruptcy...

So how long does it take to go bankrupt? Bankruptcy can be implemented very quickly but it can vary depending on your individual circumstances...

Wondering if you can get a debt relief order, sometimes referred to as DRO? This section explains what a debt relief order is, and the steps you need to take to apply for a debt relief order...